Oct 31, 2023 Mobile App Development

The Ultimate Guide To Fintech App Development Costs, Business Model & Features

If you’re thinking about creating a fintech app but are unsure about the associated expenses, we have just the guide for you. Fintech apps have made a significant impact worldwide with their innovative solutions and user-friendly experience. They’ve transformed how we manage our finances, offering everything from banking and payment services to investment and budgeting tools.

However, it’s crucial to understand the costs involved in developing a successful fintech app. In this blog post, we’ll discuss development expenses, business models, and essential features needed to create a top-notch fintech app. So sit tight and prepare yourself for an exploration of Cost to Build a FinTech App and more

Understanding Fintech App Development: An Overview

In the fast-paced digital era, the field of finance is undergoing rapid changes. Fintech applications play a critical role in driving this transformative wave. For those contemplating venturing into this competitive market, gaining a comprehensive understanding of fintech app development becomes imperative. Let us delve deeper into what it entails.

Fintech app development involves creating software applications that offer financial services to users. These apps use technology to simplify and automate banking, investing, budgeting, and payments. The objective is to improve the user experience and make financial management more convenient, efficient, and secure.

Creating a fintech app is a multifaceted process that demands technical proficiency, industry insight, and a thorough comprehension of user requirements. It encompasses various stages, such as brainstorming ideas, conducting market research, crafting designs, developing the app itself, performing rigorous testing, and finally deploying it to users. Each stage holds significant importance in guaranteeing the creation of a successful application that fulfills both user expectations and business objectives.

When developing a fintech app, it is crucial to prioritize three key factors: security, scalability, and usability. It is, however, more important to secure them since they involve users ‘sensitive and trusted financial information. One of the main reasons for app scalability is to ensure that it adjusts easily to a larger user base as well as increased levels of processing activities. Finally, usability is crucial for providing an efficient customer experience which in turn boosts adoption rates and frequent utilization.

Developers are required to be abreast with current trends, rules and regulations, and policies governing their field. There are huge consequences for not following legal and regulatory provisions of law to the fintech industry such as financial penalties and soiled reputation.

Having established a general understanding of what Fintech really is, let us now discuss the specific business modes that make these applications successful.

Decoding the Business Model of Fintech Apps

To fully understand the success of fintech apps, it’s crucial to grasp their underlying business models. These apps operate on diverse models, each with its distinct strategy for generating revenue. Let’s unravel these business models and delve into how they contribute to the triumph of fintech apps.

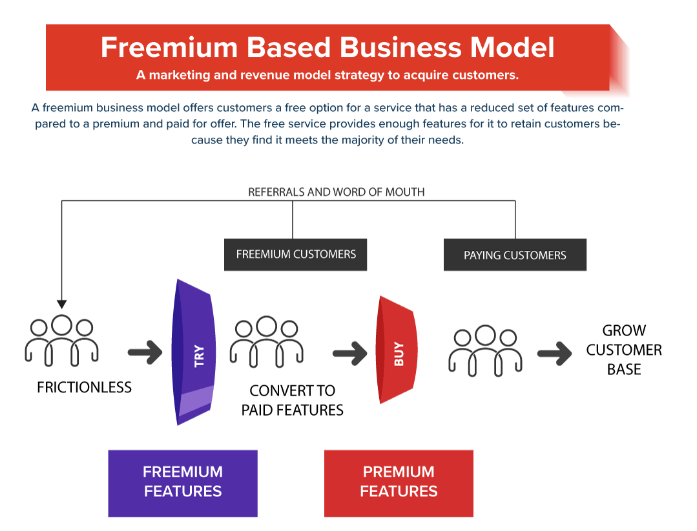

- The freemium model is one of the most prevalent business models in fintech. Under this model, fintech apps offer basic services for free but charge for more advanced features or premium services. This approach allows users to try out the app and experience its value before deciding whether to upgrade to a paid plan. It serves as a powerful driver for user acquisition and conversion.

- Another widely used business model is the subscription model. Fintech apps that employ this model charge users a monthly or annual fee for access to their services. This approach ensures a steady and predictable revenue stream while also cultivating strong customer loyalty. It works especially well for apps that offer ongoing services such as budgeting tools or investment platforms.

- Certain fintech applications utilize a transaction-based model, in which they generate revenue through transaction fees or commissions. A prime example of this is payment applications that charge a small percentage for each transaction conducted on their platform. This particular model proves beneficial for apps that experience high transaction volumes since revenue directly aligns with usage.

- Another revenue model commonly used by fintech apps is the advertising-based model. In this model, apps generate revenue by displaying advertisements within the app. However, it’s important to note that implementing this model thoughtfully is crucial to avoid negatively impacting the user experience. Additionally, attracting advertisers requires a large user base for this model to be successful.

- Lastly, there is the partnership or collaboration-based model. In this model, fintech apps partner with banks, financial institutions, or other businesses to offer value-added services. By leveraging the strengths of each partner, this model provides users with a comprehensive solution.

Understanding Factors Affecting the Cost of a Fintech App

However, before we embark on building a fintech app, there are numerous variables that should be taken into consideration as they may have an effect on the cost of development. Here are some key factors to consider:

- Complexity of features: Obviously, this will determine how much the development costs of the app will be depending on the complexity of the features that you intend to include in it. Implementing such features as AI-powered chatbots, immediate analytical results, and person-centered recommendations takes more hours and expertise. This also results in hikes in the cost of operations.

- Platform and device compatibility: The development cost will be high if you wish your app to work on a number of systems and mobile devices like iOS, Android, or browsers. There are different specifications in every platform and device such that it will take more effort and money for development and testing among them.

- Integration with third-party services: The cost of development is bound to be high especially if your app must interact with third-party services such as banking APIs, payment gateway systems, or some other identification system. Each of these integrations necessitates further development work and might also include continuing payments or rates among the vendor suppliers.

- Security and compliance requirements: The safety as well as the compatibility of fintech applications with respect to sensitive data is therefore very important. The development cost may also include robust security measures, encryption protocols, and compliance with data protection regulations.

- User experience and design: Successful use of a fintech app requires users to have a good experience. User research, UX design, and usability testing may be invested in order to make an app more convenient for use and increase its popularity. However, other design and research activities might contribute to high development costs.

- Maintenance and ongoing support: The development of a fintech app is however not enough. The application has to be properly maintained with bugs fixed as well as updated for it to remain usable and safe. Post-launch support and updates are important to budget for and thus included in the total cost of the development.

Precise consideration of these factors will help you estimate the cost of your Fintech App and make sound decisions on how to allocate resources. Remember that every application has its own price and it depends on your requirements and occasions.

An Approximate Cost to Build a Fintech App in the US

There are many elements that affect the amount involved in setting up a fintech app in the US. These include the app complexity, the features to be considered for inclusion into it as well as the compatibility with platforms and devices. Therefore, integrating third-party services, maintaining security, and adhering to regulatory mandates can further hike developmental costs.

Therefore, how much does an average fintech app roughly cost in the US? Providing a precise number here is impossible however some approximate indication may be of assistance. This may cost anything between fifty thousand dollars and half a million dollars depending on some other factors such as the complexity of different projects.

Please note that this Cost to Build a FinTech App is only an estimate and depends upon individual factors relevant to you. The maturity of the development team, the magnitude of the application, as well as the required period for project completion, are among other factors that may impact the overall budget in the long run.

The right estimation therefore should be done by getting the services of experienced app developers who can check out what you need and break down the Cost to Build a FinTech App accordingly. Investing in a reliable and well-informed team will help to reduce any extra costs and make sure that your FinTech app runs successfully.

Key Features and Their Impact on Fintech App Development Cost

The key features you include in your fintech app will play a big role in the total cost of development of your software. The functionality and user experience of such application is also directly linked to what is required for developing them as well as needed expertise. Some key features that are commonly found in successful fintech apps created by Mobile App Development Company include:

- User Authentication and Security: It is important to ensure that sensitive user information is safe from prying eyes and unwarranted intrusions. While implementing such measures may have increased costs incurred towards development, they remain necessary aspects to ensure the safety of your application.

- Personalized User Profiles: Giving users individual profiles enables them to track and administer their finances. This feature utilizes intricate algorithms and data analysis that might lead to additional expenses but yields an optimized user interface.

- Financial Tracking and Analysis: You can, however, up its game by adding real-time financial tracking, categorizing expenses, and a budgeting toolkit. Nonetheless, incorporating the same functionalities entails complex algorithms as well as connections to different financial databases that hike the prices during construction.

- Payment Integration: It supports secure transaction-making within the app for your potential clients. Nevertheless, this attribute must be seamlessly integrated into established payment gateways that conform to a myriad of financial directives, heightening development expenses.

- AI-powered Chatbots: Through this, the use of personalized recommendations, real-time customer service, and effortless user experience are offered by AI-enabled chatbots. Nevertheless, the process of creating and conditioning chatbots with state-of-the-art natural language skills is a complex matter and results in higher expenses.

Future Trends in Fintech App Development

Have a look at some of the most important future trends of Fintech app development:

- Integration of Artificial Intelligence (AI): The key in this case lies at the feet of artificial intelligence. This means that AI-based technologies can help to make fintech apps more intelligent and user-friendly by enabling advanced data analytics, personalization of services as well and better fraud prevention.

- Voice-activated banking: As smart speakers and voice assistants gain popularity, it is anticipated that voice-activated banking will soon rise as a new trend. Bank users will be able to carry out different activities like looking at their bank balance or paying using speech prompts.

- Blockchain and cryptocurrency integration: With time, we will probably see an increasing number of fintech applications that combine blockchain and crypto. These are secure transactions, trustworthy, and transparent. With the advent of decentralized lending platforms.

- Biometric authentication: Additionally, fintech apps will have an extra layer of security using biometric authentication like a thumbprint or facial recognition. In addition to that, in the future new biometric technologies including iris and voice recognition might be integrated.

- Enhanced data privacy: Increasing worries about the privacy of personal data mean that fintech applications should ensure their consumers’ safety and consent. There may be more powerful encryption methods, better data storage, and tighter controls on personal data by the users in the future.

- Expansion into new markets: However, fintech apps have already shaken the traditional financial markets and there remains scope for penetrating new territories. This could be witnessed in fintech apps seeking to address the needs of such underserved people as those found in rural areas and in underdeveloped nations.

- Seamless integration with the Internet of Things (IoT): However, fintech apps are about to get revolutionized by the IoT revolution. Real-time information for instance with respect to financial services can be provided by integrating with IOT devices like wearables or smart home gadgets and offering no hindrance in making payments.

- Increased focus on sustainability and impact investing: Given that consumers have increasingly started to be very socially and environmentally conscious, fintech apps are likely to include the components of ecological finance and impact investing in the future. This can be in the form of devices that help measure carbon footprints, green investments, or even social cause donations.

- Personal finance education and coaching: However, fintech apps are capable of providing more than just financial services; they can also enhance their capabilities and guide users towards better decision-making regarding matters related to finance. There could also be developments such as personalized financial mentoring, digital budgeting solutions, and educative content in order to increase knowledge of finances.

- Integration with augmented reality (AR) and virtual reality (VR): Therefore, AR and VR, although just emerging as industry disruptors, have already begun finding applications even in fintech.

Conclusion

In conclusion, this ultimate guide on fintech app development costing including business models and must-features, is obvious that starting a successful fintech app demands due diligence, time, and money. The complexities of the different kinds of business models affecting Cost to Build a FinTech App must be understood by anyone willing to develop an app. It’s essential to recall that every project regarding developing a fintech app is different. The various factors that determine the costs include the complexity of features, platform compatibility, integration with third-party services, security and compliance requirements, user experience and design, and ongoing maintenance and support. Considering these factors and getting advice from expert app developers give an account of your specific costs. Finally, you also need to select relevant features for your fintech app. Some examples of these features include user authentication and security; personalized user profiles; payment integration, financial tracking, and analysis; and AI-powered chatbots. However, there is a need to balance cost with functionality, providing only those features necessary for your customers’ needs and business requirements.

However, in the near future, there will be more interesting trends for the development of innovative fintech apps including the integration of artificial intelligence, voice banking, blockchain, and crypto-currency integration, biometric authentication, increased security of users’ data, expanding geography, smooth integration within “smart” devices. While looking for an App Development Company to develop your FinTech app, get someone who is qualified and has enough power to offer solutions to your special needs. Investing in a reliable and knowledgeable team will help the success of your fintech app at minimal costs. So, what are you waiting for? Take the plunge into the world of fintech app development and start revolutionizing the way people manage their finances today!

Alcax Solutions is a top mobile app development company in USA that connects you with the best farm weather app developers with flexible and economical engagement models ranging from hourly, monthly, and fixed-cost billing. Hire Mobile App Developer from Alcax today and embark on your mobile app development journey with confidence.